“If We Don’t Address the Fundamental Material Issues, It’s Like Trying to Grow Rice in the Desert!”

High-end medical devices are considered one of the key indicators of a city’s manufacturing and technological prowess, as they encompass new materials, software and hardware, mechanics, acoustics, optics, microelectronics, and sensors, with potential links to artificial intelligence and new energy in the future. More and more Shenzhen-based companies are breaking the dominance of imported brands, which once controlled 90% of the market, through foundational innovations. These companies are steadily progressing from domestic substitutions to becoming industry leaders.

The Ceo of Surgsci Medical Ltd. Feng Gengchao

“If we don’t address the fundamental material issues, it’s like trying to grow rice in the desert,” explained Feng Gengchao, co-founder of Shenzhen Surgsci Medical Technology Co., Ltd. “It might not be impossible, but the costs will definitely be higher, and the results won’t be as good as the rice grown in the fertile black soil of the northeast.” This is why the three founders chose a path known for its high investment, long cycle, and uncertain results at the outset of their venture.

“We must solve the foundational issues first before deciding what to build on them.”

Three Years to Succeed or Move On

To determine their direction, the three founders of Surgsci visited numerous medical device companies in the Bohai Rim and Yangtze River Delta regions, where the industry is concentrated. They discovered a common problem: companies were importing materials and parts for assembly, but often couldn’t obtain the best quality components, leading to unsatisfactory final products.

The three founders of Surgsci

“This made doctors feel that domestic equipment was inferior to imported ones. The high-end surgical equipment market remained dominated by brands like Johnson & Johnson, Medtronic, Olympus, and Stryker,” said Feng Gengchao. “We weren’t satisfied with this, both emotionally and commercially. If we could succeed, it could be a significant business opportunity.”

The Eggshell Research Institute’s “Smart Ultrasound Industry White Paper” highlighted the core issue of “slow localization progress in high-end fields,” attributing it to the “limited self-production capacity of core raw materials and high-end components.” It specifically cited ultrasonic scalpels, noting that key titanium alloy materials mostly need to be imported, which is costly and crucial for enhancing product performance and creating technical barriers.

Ultrasonic scalpels convert electrical energy into mechanical energy through high-frequency oscillation, releasing massive energy that quickly converts to mechanical and thermal energy, rapidly cutting tissues. The energy is concentrated at a point, instantly raising the tissue temperature to 70°C-100°C, achieving quick vascular closure and earning the nickname “bloodless surgery knives.”

So, an agent, a surgeon, and an engineer teamed up to form Surgsci. In 2018, they decided to focus on ultrasonic scalpels, starting with basic material research.

Surgsci’s original laboratory

The Irrevocable Path of Entrepreneurship

“We didn’t initially consider financing or even understand capital. We pooled 20 million yuan, agreeing that if we ran out of money or couldn’t figure out the technology within three years, we’d quit and return to our old jobs,” said Feng Gengchao. “In hindsight, there was no turning back; we had invested all our savings, and failure would mean starting over from scratch.”

Five Years Later: Localization Rate Soars from 1.2% to 14.3%

Solving material issues not only ensures product quality but also provides life-saving solutions for three then-unforeseen risks.

Firstly, supply chain constraints. As geopolitical dynamics shift, independence in raw materials ensures stable, large-scale production, especially critical in high-end manufacturing.

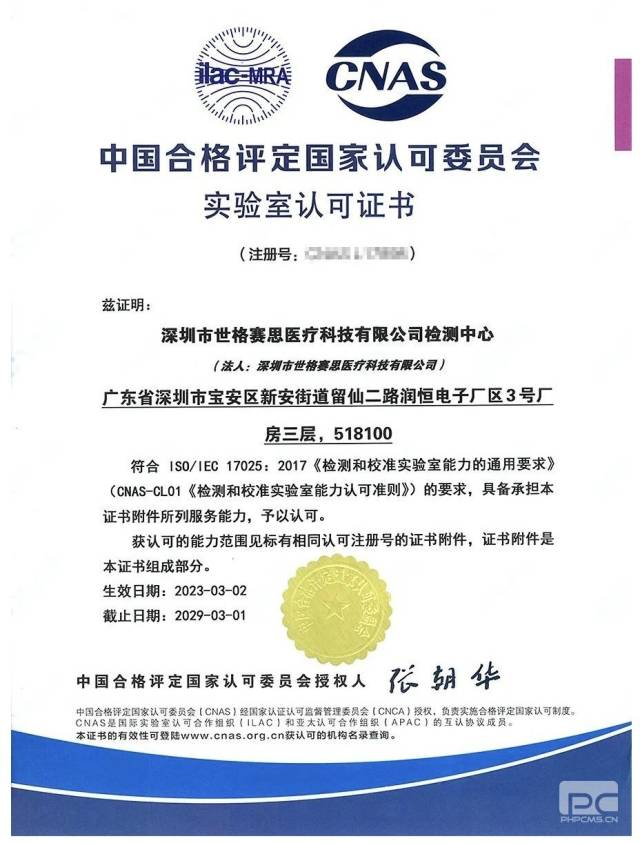

Surgsci Factory CNAS Certificate

Secondly, cost reduction. Self-developed foundational technology can significantly lower costs, particularly after ultrasonic scalpels were included in national procurement.

In December 2021, a 16-province alliance led by Guangdong saw average ultrasonic scalpel prices drop by about 70%, with conventional 3mm scalpels falling from 7,730 yuan to 545 yuan, a 93% decrease.

While drastic national procurement price cuts benefit patients, manufacturers’ ability to self-develop is crucial to recouping years of R&D investments. Without self-development, entering the trillion-yuan procurement market is nearly impossible. Surgsci and other innovative companies successfully won bids in this procurement.

Moreover, deep understanding of core issues enables bolder innovations in different scenarios. Material innovation has also laid the foundation for Surgsci’s expansion into diverse fields such as energy platforms, medical consumables, and pet medical products.

“Currently, we don’t rely on imports for our core materials,” stressed Feng Gengchao. “We simply don’t rely on them anymore.”

Ultrasonic scalpels dominate the energy instrument platform and have the greatest potential for domestic substitution. By 2021, domestic brands’ market share of ultrasonic scalpels rose from 1.2% in 2016 to 14.3%, marking initial success in domestic substitution, though there is room for improvement. Each percentage point increase represents countless steadfast efforts and explorations by people like Feng Gengchao. Surgsci is just one example among many companies practicing domestic substitution in the medical device industry.

Surgsci Ultrasonic Scalpel System

Electrification Highlights Shenzhen’s Advantages

High-end medical devices are one of the important indicators of a city’s manufacturing and technological level.

Years of industrial foundation give Shenzhen the confidence to have higher expectations for the high-end medical device industry. In the “20+8” industrial cluster 2.0 version released in 2024, high-end medical devices, along with semiconductors and integrated circuits, artificial intelligence, biomedicine, and new energy, are listed as seven strategic priority industries, supported with extraordinary resources.

As of May 2023, Shenzhen has 1,800 medical device manufacturing companies, including 19 listed companies and 11 companies with an annual output value of over 10 billion yuan. International giants like GE Medical, Siemens, and Philips have also set up in Shenzhen, with annual output value surpassing 1 trillion yuan for the first time.

According to the plan, by 2025, the added value of the high-end medical device industry in the city will reach 65 billion yuan, and operating income will reach 200 billion yuan. The goal is to build a globally renowned high-end medical device R&D center and a leading domestic and world-class industrial agglomeration area. The plan first aims to address the issue of weak original innovation capabilities.

In Shenzhen’s coordinates, the high-end medical device industry used to show a “south R&D, north manufacturing” pattern.

To summarize: Nanshan is known for its headquarters; Guangming has key enterprises and major infrastructure support; Pingshan is focusing on the national biological industry base, laying out segmented tracks; and Yantian focuses on genetics and in vitro diagnostics. After the Spring Festival in 2023, Longhua announced the release of nearly 20 square kilometers to build a trillion-yuan international medical device city, covering core links in the entire chain. It is connected with Baoan, the traditional electronic manufacturing area, subtly changing Shenzhen’s industrial landscape.

In the national coordinates, there has always been a saying “China’s medical devices look at Shenzhen.”

As of 2022, Shenzhen’s high-end medical device output value accounted for about 10% of the country, with exports accounting for about 13%, nearly 100 companies with an output value of more than 100 million yuan, including the number of listed companies and their market value leading the country.

When visiting institutions, schools, and medical companies across the country, Feng Gengchao also found that medical devices have distinctive cluster distributions in different regions across the country.

“In my personal feeling, the Yangtze River Delta is like a dividing line. To the north, the Bohai Rim area mainly produces non-powered consumables such as gloves and infusion sets. To the south, the Greater Bay Area mainly produces powered medical devices such as ultrasound machines, AEDs, monitors, and ventilators. The Yangtze River Delta has the advantage of chips and molds, and has both powered and non-powered products,” said Feng Gengchao. “Producing ordinary toothbrushes, Shenzhen may not have an advantage, but producing electric toothbrushes, Shenzhen definitely has an advantage. The same is true for medical devices.”

He suggested, “Shenzhen should continue to leverage its accumulated electronic industry hardware and software advantages, electrifying and intelligentizing manual tools, including medical devices. This is an upgrade of the original industry. As long as tools are electrified, Shenzhen’s industrial advantages will be very clear.”

Looking back at the 30-year development of the medical device industry in Shenzhen:

In the 1980s, in the fertile soil of the electronics industry, Shenzhen’s medical device industry emerged, independently developing China’s first MRI device and color ultrasound. In 2020, among the first 16 manufacturing innovation centers established nationwide, the only national high-performance medical device innovation center was located in Shenzhen.

In recent years, Shenzhen has made breakthroughs in a series of core technologies in the high-end medical device field, including the first domestically-produced ECMO, raw materials for cardiovascular and cerebrovascular implantable devices, and high-performance medical titanium alloys.

More and more innovators like Feng Gengchao and companies like Surgsci are steadfastly paving the way for independent innovation and self-reliant high-quality development. They will ultimately overcome numerous challenges, with innovation being the sole answer.